Debt investors

GSK’s Treasury department monitors and manages the Group’s external and internal funding requirements and financial risks in support of our strategic objectives. GSK operates on a global basis, primarily through subsidiary companies, and we manage our capital to ensure that our subsidiaries are able to operate as going concerns and to optimise returns to shareholders through an appropriate balance of debt and equity.

Credit rating table

GSK plc has solicited credit ratings from S&P and Moody’s:

| S&P | Moody's | |

|---|---|---|

| Short-term rating | A-1 | P-1 |

| Long-term rating | A | A2 |

| Outlook | Stable | Stable |

As at 31st December 2025

Liquidity

GSK’s policy is to borrow centrally in order to meet anticipated funding requirements. The strategy is to diversify liquidity sources using a range of facilities and to maintain broad access to financial markets.

Short-term liquidity

GSK has access to short-term finance under a $10 billion US commercial paper programme; £5 billion Euro commercial paper programme; £1.6 billion of medium-term committed facilities; $2.2 billion of 364 day committed facilities as well as the use of cash and cash equivalents and liquid investments.

The committed facilities were undrawn as at 31st December 2025.

Medium / long-term liquidity

GSK has a £20 billion Euro Medium Term Note (EMTN) programme and a US shelf registration.

| Programme | Limit | Rating |

|---|---|---|

|

US Commercial Paper Euro Commercial Paper |

$10 billion £5 billion |

A-1 / P-1 A-1 / P-1 |

|

Euro Medium Term Note programme |

£20 billion |

A / A2 |

|

US Shelf |

Unlimited |

A / A2 |

Issuing entities listed under EMTN programme:

- GSK plc

- GlaxoSmithKline Capital plc

- GSK Capital B.V.

- GlaxoSmithKline Capital Inc.

Issuing entities listed under US shelf programme:

- GSK plc

- GlaxoSmithKline Capital plc

- GlaxoSmithKline Capital Inc.

Bond table

Below is a table of the bonds guaranteed by GSK plc as at 31st December 2025:

| Issuer | Issue currency | Issue amount (millions) | Issue date | Maturity date | Programme | Coupon | ISIN |

|---|---|---|---|---|---|---|---|

|

Capital plc |

EUR |

1,000 |

21/05/2018 |

21/05/2026 |

EMTN |

1.250% |

XS1822828122 |

|

Capital plc |

EUR |

700 |

12/09/2017 |

12/09/2026 |

EMTN |

1.000% |

XS1681519184 |

|

Capital plc |

USD |

400 |

13/03/2025 |

12/03/2027 |

US Shelf |

4.315% |

US377373AM70 |

|

Capital plc |

USD |

600 |

13/03/2025 |

12/03/2027 |

US Shelf |

SOFR + 0.500% |

US377373AN53 |

|

Capital B.V. |

EUR |

500 |

28/11/2022 |

28/11/2027 |

EMTN |

3.000% |

XS2553817680 |

|

Capital plc |

GBP |

308* |

18/12/2012 |

20/12/2027 |

EMTN |

3.375% |

XS0866588527 |

|

Capital Inc. |

USD |

1,750 |

15/05/2018 |

15/05/2028 |

US Shelf |

3.875% |

US377372AN70 |

|

Capital plc |

JPY |

42,500 |

21/09/2023 |

21/09/2028 |

EMTN |

0.883% |

XS2690015008 |

|

Capital plc |

GBP |

750 |

12/05/2020 |

12/10/2028 |

EMTN |

1.250% |

XS2170601848 |

|

Capital plc |

USD |

1,000 |

25/03/2019 |

01/06/2029 |

US Shelf |

3.375% |

US377373AH85 |

|

Capital plc |

EUR |

500 |

12/09/2017 |

12/09/2029 |

EMTN |

1.375% |

XS1681520356 |

|

Capital Inc. |

USD |

850 |

13/03/2025 |

15/04/2030 |

US Shelf |

4.500% |

US377372AP29 |

|

Capital plc |

EUR |

750 |

21/05/2018 |

21/05/2030 |

EMTN |

1.750% |

XS1822829799 |

|

Capital B.V. |

EUR |

700 |

19/11/2024 |

19/11/2031 |

EMTN |

2.875% |

XS2933691433 |

|

Capital B.V. |

EUR |

700 |

28/11/2022 |

28/11/2032 |

EMTN |

3.125% |

XS2553817763 |

|

Capital plc |

GBP |

574* |

19/12/2001 |

19/12/2033 |

EMTN |

5.250% |

XS0140516864 |

|

Capital Inc. |

USD |

500 |

06/04/2004 |

15/04/2034 |

US Shelf |

5.375% |

US377372AB33 |

|

Capital Inc. |

USD |

750 |

13/03/2025 |

15/04/2035 |

US Shelf |

4.875% |

US377372AQ02 |

|

Capital plc |

GBP |

750 |

12/05/2020 |

12/05/2035 |

EMTN |

1.625% |

XS2170609072 |

|

Capital B.V. |

EUR |

600 |

19/11/2024 |

19/11/2036 |

EMTN |

3.250% |

XS2933692753 |

|

Capital Inc. |

USD |

2,750 |

13/05/2008 |

15/05/2038 |

US Shelf |

6.375% |

US377372AE71 |

|

Capital plc |

GBP |

631* |

06/03/2008 |

09/03/2039 |

EMTN |

6.375% |

XS0350820931 |

|

Capital plc |

GBP |

478* |

10/04/2007 |

10/04/2042 |

EMTN |

5.250% |

XS0294624373 |

|

Capital Inc. |

USD |

500 |

18/03/2013 |

18/03/2043 |

US Shelf |

4.200% |

US377372AJ68 |

|

Capital plc |

GBP |

371* |

18/12/2012 |

18/12/2045 |

EMTN |

4.250% |

XS0866596975 |

*Following a tender offer settled on 17th November 2022: £292m of the 2027 notes, £350m of the 2033 notes, £522m of the 2042 notes and £429m of the of the 2045 notes was tendered. Through a further bilateral buyback, on 13th February 2023 GSK repurchased £76m of the 2033 notes and £69m of the 2039 notes.

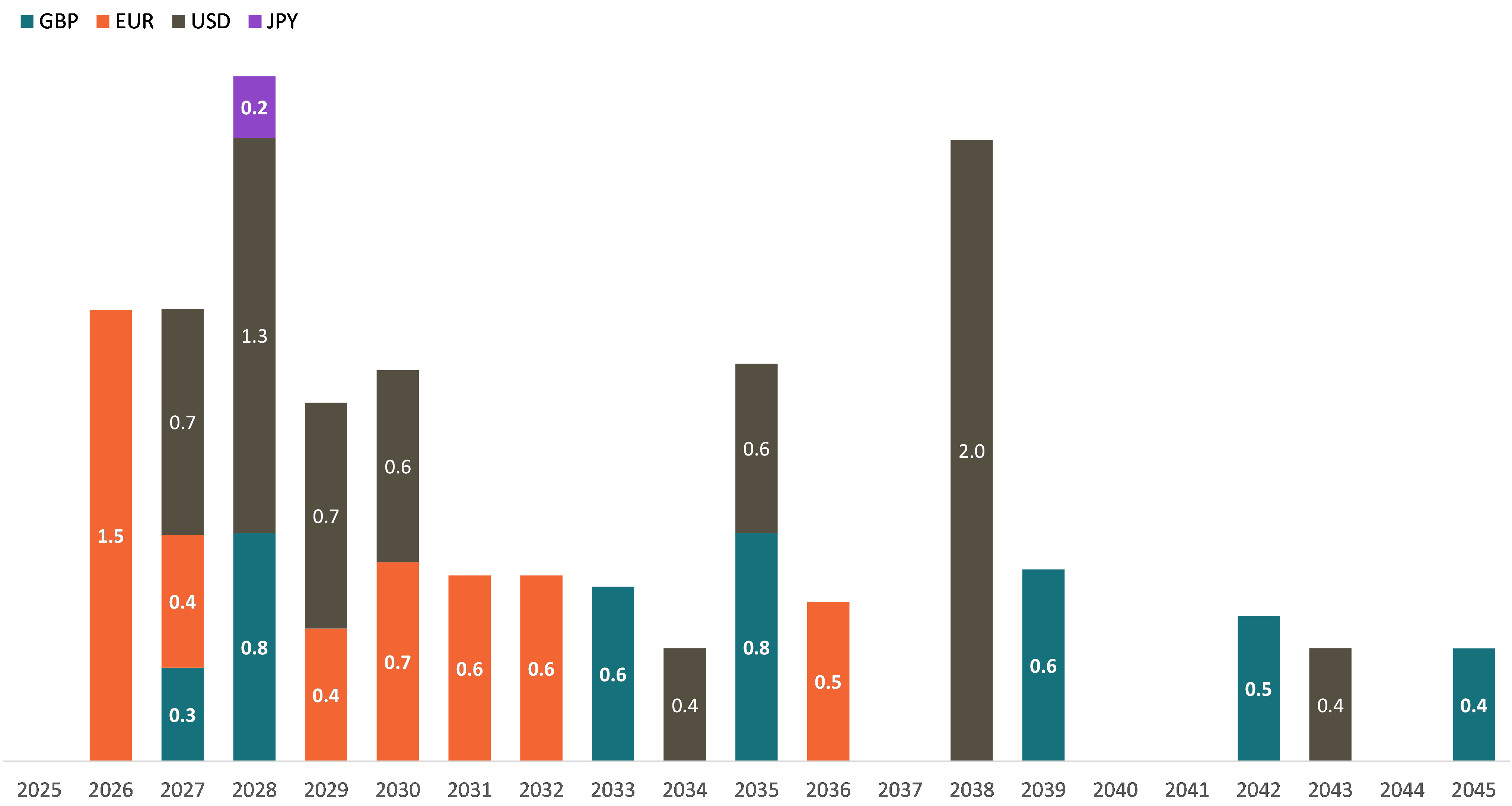

Debt maturity profile

Bond debt maturity profiles (£bn equivalent)

USD, EUR & JPY bonds converted to GBP using the spot rates on 31st December 2025 as follows:

GBPEUR 1.1454

GBPUSD 1.3456

GBPJPY 210.72

Total gross bond debt in issue as at 31st December 2025: £15.6bn

Contact details

Timothy Woodthorpe

Senior Vice President and Group Treasurer

Email: cf.treasury@gsk.com

GSK Investor Relations

Email: GSK.Investor-Relations@gsk.com

Tel: +44 (0)20 8047 5000