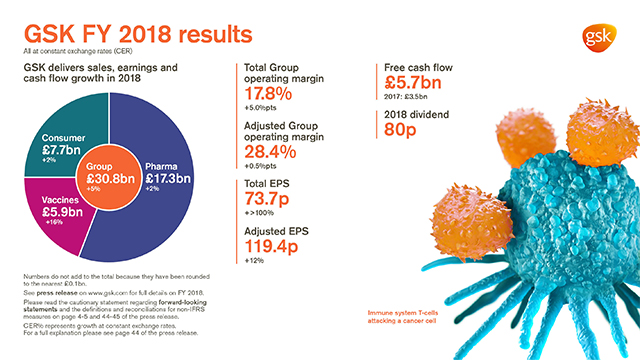

GSK delivers sales, earnings and cash flow growth in 2018

Issued: London, UK

Total EPS 73.7p, +>100% AER, +>100% CER; Adjusted EPS 119.4p +7% AER, +12% CER

Full results announcement (PDF)

Download the FY 2018 results announcement

2018 financial, product and strategy highlights

- Group sales £30.8 billion, +2% AER, +5% CER

- Pharmaceuticals sales £17.3 billion, flat AER, +2% CER; Vaccines sales £5.9 billion, +14% AER, +16% CER; Consumer Healthcare sales £7.7 billion, -1% AER, +2% CER

- Total new Respiratory product sales £2.6 billion, +35% AER, +38% CER

- Total HIV sales £4.7 billion, +9% AER, +11% CER. Dolutegravir-based regimens £4.4 billion, +14% AER, +16% CER

- Shingrix sales £784 million, +>100% AER, +>100% CER

- Total Group operating margin 17.8%, +4.3 percentage points AER, +5.0 percentage points CER

- Adjusted Group operating margin 28.4%, flat AER, +0.5 percentage points CER. (Pharmaceuticals: 33.3%; Vaccines 33.0%; Consumer Healthcare 19.8%)

- Total EPS 73.7p, +>100% AER, +>100% CER, reflecting stronger operating performance, lower restructuring and impairment charges as well as a favourable comparison with impact of US tax reform in 2017

- Adjusted EPS 119.4p, +7% AER, +12% CER, driven by improved operating margin and continued financial efficiencies

- Net cash flow from operations £8.4 billion. Free cash flow £5.7 billion, improvement reflecting greater focus on cash conversion, particularly working capital

- 23p dividend declared for the quarter; 80p for full year 2018

- 4 major transactions, including new Consumer Healthcare JV, announced in 2018 to support strategy and reshape of the Group’s portfolio

2019 guidance

- Expect Adjusted EPS to decline -5% to -9% CER reflecting recent approval of a generic competitor to Advair in the US. Guidance also reflects expected impact of Tesaro acquisition and assumes Consumer Healthcare nutrition disposal

and Consumer JV with Pfizer close as previously indicated - Expect 80p dividend for 2019

Pipeline update and newsflow

- Rebuild of Pharmaceuticals pipeline continues with 33* of the 46* new medicines now in development targeting modulation of the immune system

- Major progress made in immuno-oncology pipeline with 16* assets now in clinical development, reflecting organic progression, the Tesaro acquisition and the alliance with Merck KGaA, Darmstadt, Germany*

- Major data readouts and other significant newsflow expected on multiple new medicines in HIV, Oncology, Immuno-inflammation and Respiratory in 2019:

FDA approval decision expected for dolutegravir + lamivudine in H1

FDA filings planned for long-acting injectable cabotegravir + rilpivirine in H1 and fostemsavir for highly treatment-experienced patients in H2

Pivotal stage data readouts expected for BCMA for 4L multiple myeloma, Zejula for 1L maintenance ovarian cancer and PD1 dostarlimab for endometrial cancer

Updated phase I PFS data from DREAMM-1 study for BCMA to be published in leading journal in H1

Phase III start planned for anti-GMCSF for treatment of rheumatoid arthritis in H2

Results of pivotal CAPTAIN study to support filing of Trelegy for use in asthma expected in H1

* Includes M7824, the subject of the alliance with Merck KGaA, Darmstadt, Germany, expected to close in Q1 2019.

Emma Walmsley, Chief Executive Officer, GSK said:

“GSK delivered improved operating performance in 2018 with Group sales growth, strong commercial execution of new product launches, especially Shingrix, continued cost discipline and better cash generation.

“It was also a significant year for the Group strategically, with the launch of a new R&D strategy focused on immunology, genetics and new technologies, together with a series of transactions that support our strategy and reshape of the Group’s portfolio.

“We are making good progress against our priority to rebuild our Pharmaceuticals pipeline, particularly in oncology. Since July, we have doubled the number of oncology assets in clinical development to 16 through the advancement of our internal programmes and with targeted business development including the recently completed acquisition of Tesaro and our new alliance with Merck KGaA that is expected to close in Q1 2019. During 2019, we expect to receive pivotal data on three new cancer medicines, all of which have the potential to be launched in the next two years.

“We are also focused on completing the transactions to divest our Consumer Healthcare nutrition business to Unilever; and the formation of our new joint venture with Pfizer that will create a new, world leading Consumer Healthcare company and which provides a unique opportunity to deliver substantial value for shareholders.

“Finally, I would like to thank all our customers, suppliers and employees for their support and hard work in 2018 and look forward to working with them in 2019, which will be an important year of execution for GSK.”

Watch Emma Walmsley, CEO, give her take on our progress in 2018.

Watch a 60 second summary of our performance in 2018.

Broadcast quality versions of these films are available on request for use by media from our video footage library. To request access, please contact us through our media relations team on +44 (0)20 8047 5502 or email corporate.media@gsk.com

About GSK

GSK – one of the world’s leading research-based pharmaceutical and healthcare companies – is committed to improving the quality of human life by enabling people to do more, feel better and live longer. For further information please visit www.gsk.com/about-us.

Cautionary statement regarding forward-looking statements

This document contains statements that are, or may be deemed to be, “forward-looking statements”. Forward-looking statements give the Group’s current expectations or forecasts of future events. An investor can identify these statements by the fact that they do not relate strictly to historical or current facts. They use words such as ‘anticipate’, ‘estimate’, ‘expect’, ‘intend’, ‘will’, ‘project’, ‘plan’, ‘believe’, ‘target’ and other words and terms of similar meaning in connection with any discussion of future operating or financial performance. In particular, these include statements relating to future actions, prospective products or product approvals, future performance or results of current and anticipated products, sales efforts, expenses, the outcome of contingencies such as legal proceedings, and financial results. Other than in accordance with its legal or regulatory obligations (including under the Market Abuse Regulation, the UK Listing Rules and the Disclosure and Transparency Rules of the Financial Conduct Authority), the Group undertakes no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise. The reader should, however, consult any additional disclosures that the Group may make in any documents which it publishes and/or files with the SEC. All readers, wherever located, should take note of these disclosures. Accordingly, no assurance can be given that any particular expectation will be met and investors are cautioned not to place undue reliance on the forward-looking statements.

Forward-looking statements are subject to assumptions, inherent risks and uncertainties, many of which relate to factors that are beyond the Group’s control or precise estimate. The Group cautions investors that a number of important factors, including those in this document, could cause actual results to differ materially from those expressed or implied in any forward-looking statement. Such factors include, but are not limited to, those discussed under Item 3.D ‘Risk Factors’ in the Group’s Annual Report on Form 20-F for 2017. Any forward looking statements made by or on behalf of the Group speak only as of the date they are made and are based upon the knowledge and information available to the Directors on the date of this report.